Buy NOW and you can receive a tax deduction through Section 179 of the IRS tax code.

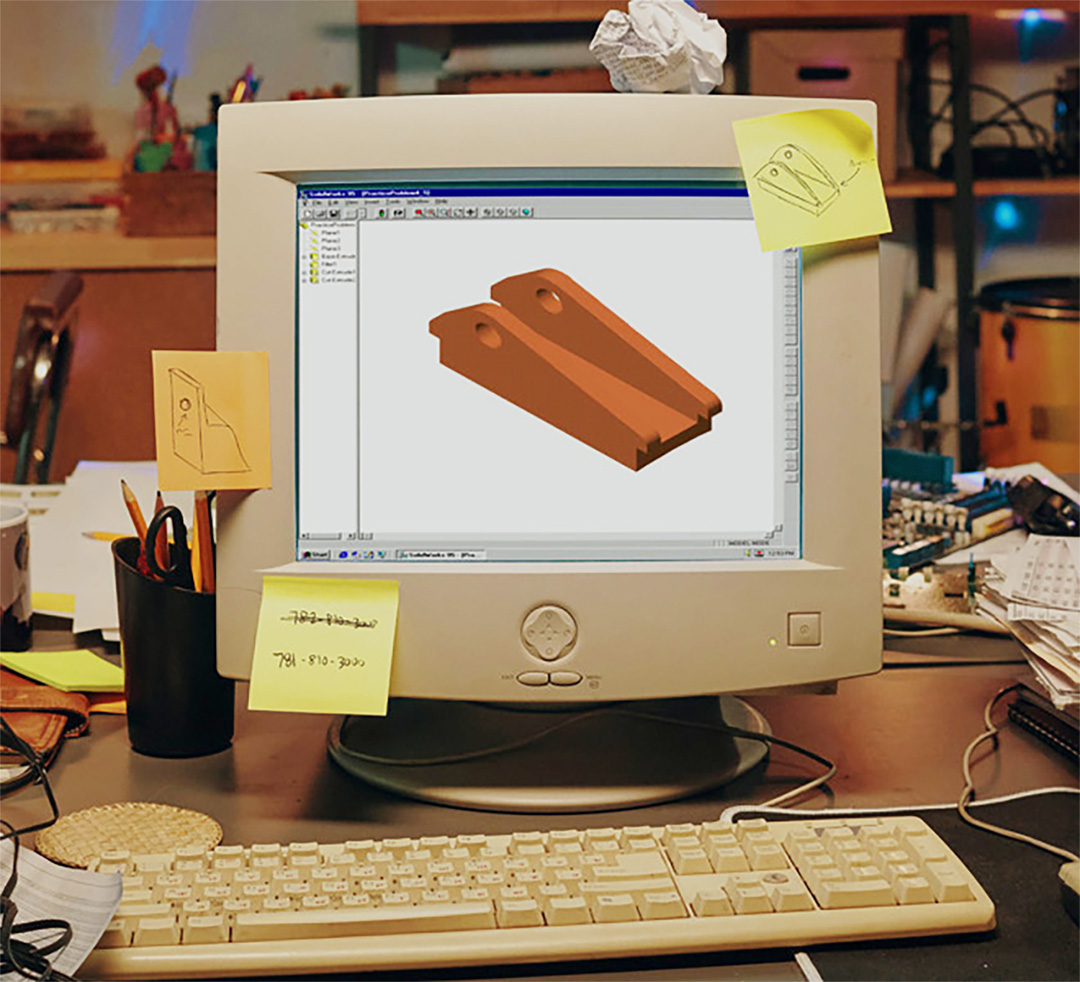

Considering a SOLIDWORKS purchase before the end of the year?

Section 179 allows businesses to deduct the full purchase of qualifying equipment and/or software purchased or financed during the 2022 tax year. This means that if you buy or finance a piece of qualifying equipment or software, you can deduct the FULL purchase price from your gross income.

SOLIDWORKS software DOES qualify!

By taking advantage of this deduction, you could potentially save more than you actually spend on your SOLIDWORKS purchase!

The end of 2022 is near so NOW is the time to take advantage of all our year-end savings.

Section 179 can provide you with significant tax relief for this tax year, but your SOLIDWORKS purchase must be financed and in place by midnight December 31, 2022, so don’t wait!

Click here for more information about Section 179 or speak with your personal accountant.

Click here to have one our of experts from The SolidExperts contact you today!

SUBMIT YOUR COMMENT